Mr. Kenta Murakami, CEO of Educare Co., Ltd.

Unable to pay university fees―Mr. Kenta Murakami, the CEO of Educare Co., Ltd., says that such a crisis in his school days led him to pursue the education finance business. We interviewed him about his company, which focuses on a “study now, pay later” scholarship program to support everyone attempting to attain a quality education and realize a fulfilling career, regardless of their financial background.

―What are “study now, pay later” scholarships?

CEO of Educare Co., Ltd.

They are a type of scholarship that allow students to start repaying a given percentage of their income, say 10% of their monthly salary, when they get a job and earn more than a certain amount. This tuition support system is called an Income Share Agreement (ISA) and is gradually becoming popular among nursing and medical schools overseas, including in the United States and the United Kingdom. The main differences from typical scholarships include that repayments can be made at a fixed rate, rather than at a fixed amount, and that there is no need for a co-signer.

We are currently undergoing the licensing procedure, but plan to first offer regular fixed-payment loans. After taking appropriate steps, such as establishing a dialogue with the authorities, we’d like to offer an ISA as one of our offerings. Basically, we aren’t necessarily sticking to ISAs, but instead intend to run our education finance company by providing other types of loans, including regular loans.

―Do students not have to repay the loan if their income never reaches a certain level?

At least in the case of ISAs, they don’t have to repay until their annual income reaches a certain level. In addition, they are temporarily exempt from repayment while on temporary leave due to illness, pregnancy, or childbirth. Since interest isn’t in the equation and repayment limits are set, payments won’t skyrocket, either. ISAs provide future-oriented finance, and we intend to become an education finance company that offers ISAs, loans, and other services to address educational inequality and to create a world where fewer people have difficulty paying tuition fees.

―Have you already launched the company?

Since we are a financial startup, we need a financial business license and are in the process of obtaining one. As mentioned earlier, we plan to first offer regular fixed-payment loans. In terms of ISAs, there are still legal and accounting issues to consider, and we need to have careful conversations with the authorities, so our plan is to launch them only after diligent consideration and discussion. We also belong to the Fintech Association of Japan, have received two rounds of venture capital investments, and have attracted people with long financial experience as members.

―How do you plan to shape your business?

We will start by focusing on students in the nursing industry (in particular, adult nurses who want to go to nursing graduate school). This is because the percentage of scholarship use in this industry is already extremely high compared to other industries. As with medical schools, nursing schools are expensive, and the support provided by the Japan Student Services Organization (JASSO), an independent governmental agency, often falls short.

There are also hospital scholarships that offer financial aid to students on the condition that they work at a specific hospital after graduation. However, that can be burdensome for students in that, for example, they can’t quit the hospital even when they want to because they have to pay back all of their loans in a lump sum when they quit. When we interviewed nurses and nursing students, there were quite a few who said they would have liked to have used an ISA if one had been available in their school days.

―You see a lot of need, right?

Scholarship use itself has increased from about 1 in 10 people a decade or two ago to about 1 in 2 people today, showing an increasing need for student aid. However, current education finance in Japan is almost entirely monopolized by JASSO. I think it would be good for Japan to have more players offering education finance like there are overseas.

―You say that your own experience led you to start your company. Could you tell us about it?

When I was a senior in college, I became unable to afford tuition. It was the first time that the hardships of money really resonated with me, which was a complete change from my privileged background. I ended up earning money myself and managed to pay my school fees, but I don’t want anyone to feel that hopelessness.

―That experience led you to your business idea, right?

That’s right. Although even before then, I wanted to start my own business because my parents ran a family-operated business; so that experience gave me a vague idea that I could do something about tuition fees and financial aid for education. I couldn’t immediately think of a solution, so after graduation, I worked in the Financial Services Division of GE Japan and was engaged in M&A advisory at KPMG Japan. I found out about ISAs two years ago when I was doing research to find something to start a business with. I thought that this kind of future-oriented finance would break the vicious cycle of education inequality, so I started the company last year.

―How do you plan to raise the funds for support?

We are currently exploring various systems and are engaged in private dialogues with many partners. In particular, there is a great deal of interest from the social sector, including foundations, endowments, and financial institutions with plenty of CSR budgets. With the money we could get from those sources, we are considering first setting up a system that pays nursing schools in advance for enrollment, tuition, and other school fees on behalf of nursing students, like consumer credit service company in Japan such as Japan Consumer Credit Service (JACCS) or Orient Corporation (Orico) does.

―What are your thoughts on profitability?

A loan basically requires the borrower to repay the money they borrow plus interest, but an ISA is more like equity financing(*), so our ISA model will be more like an investment in future nurses. If we provide 2 million yen for one student and get 3 million yen back, the return of 1 million yen goes to support the next student. In this way, it will work as an ecosystem where funds are circulated. We want to make this a business predicated on the spirit of paying it forward and mutual support, where heroes are born among struggling people and the returns they bring are passed on to the next generation.

―I suppose there may be cases where you can’t get a return at all, then.

Our ISA simulation also assumes the possibility of the repayment falling below the principal due to reasons such as not reaching the specified annual income or prolonged illness. We also assume that there will be a certain number of people who underreport their incomes to avoid repayment, so we are working with our lawyers on a provision that prescribes some sort of penalty to prevent that kind of avoidance.

―Does that mean you are considering other ways to make revenue?

We are considering other revenue streams such as merchant fees from schools. We are also thinking about monetizing the students we support through education finance, including ISAs, in a way similar to human resources businesses, and expect that revenue from this source would be quite large. I think an education finance business is a business that doesn’t make a lot of commercial profit if it is conventionally managed, so we need to be creative.

―If you succeed, you can be both socially impactful and profitable at the same time.

We hope so. I don’t want this EduCare business to be just a “moneylender.” I want to add value to our tuition support so that those who receive it will eventually improve their careers and annual incomes. I hope that financial education and vocational training on our human resources platform will also help those who receive them to earn more and work more vigorously than others after graduation.

―Current scholarship providers in Japan aren’t really involved with their scholarship students at all unless they fall behind in repayment.

In the United States, education finance and career support are often offered as a set. If a scholarship provider demands repayment, I think they should take direct responsibility for the students’ careers after graduation. Doing so will increase the likelihood of repayment for the provider and also benefit the students, aligning incentives between the two parties to increase social and business significance. In the future, we want to become an education finance company that is both profitable and socially impactful in both the nursing and ISA industries to address the issue of education inequality. To this end, we will continue to focus on communication with various partners, including the government, financial institutions, schools, and students.

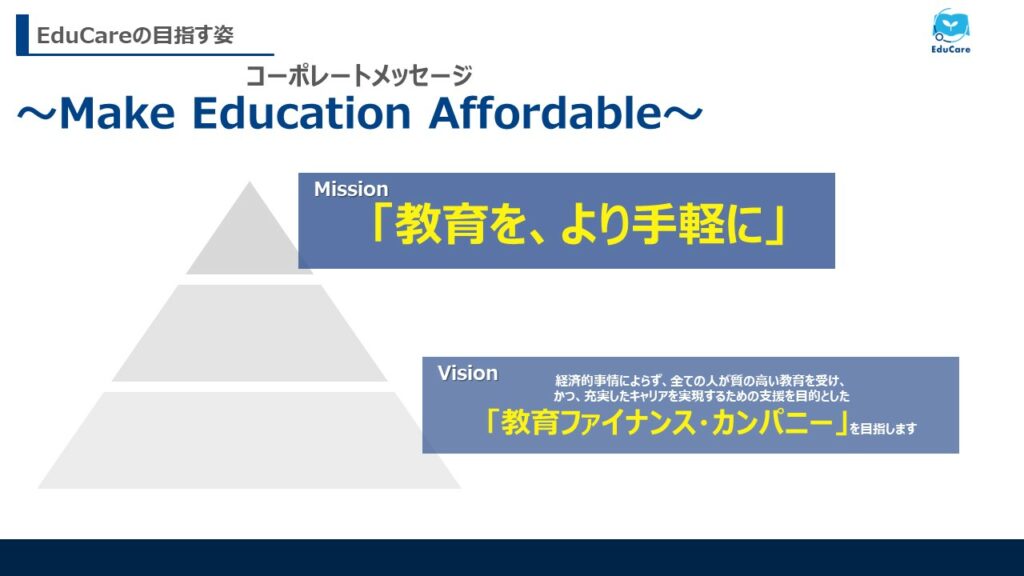

―To close, please tell us about what the Make Education Affordable Initiative is, which EduCare is aiming to achieve.

In general, companies that make a living by lending money lend only to working people, so the reality is that it’s difficult to finance funds for tuition and other fees from banks or consumer finance companies.

On the other hand, as 1 in 2 students uses a scholarship, the market is clearly large and its needs are growing, and there are students, including nurses, who are almost guaranteed to be able to repay once they graduate. Nevertheless, financing is inaccessible to them. I feel there is a kind of contradiction or “distortion.”

For example, we could identify and partner with schools that presumably have a high return on investment in education (educational ROI) in terms of aspects like starting salaries and salary increase rates as well as higher professional education institutions that provide vocational training for jobs with high future demand. If we finance students who go to such schools or institutions, we can minimize our risks and still support students.

If we also provide further career support and financial education to the supported students so that they can advance their careers and raise their annual incomes, both we and the students will benefit, attracting interest and involvement from financial institutions, hospitals, and human resources companies. I expect this kind of ecosystem will be created.

The longer our record of student loans, the more data-driven our finance will become, enabling us to lend to students who really want to learn but are struggling with tuition. This is the world we want to see (through Make Education Affordable).

Since our business is new, it is hard to be accepted and there is still the licensing procedure we must complete. It requires a lot of focus and energy, but we will remain tenacious until it takes form.

*Equity financing: Raising funds by issuing shares rather than borrowing

| Company name:Educare Co., Ltd. |

| Founded:June 2022 |

| Number of employees:6(including contractors) |

| Main business:Education finance business focusing on nursing students URL:https://www.edu-care.co.jp |

This article is part of a series of articles introducing venture companies working together as ICF members to resolve societal issues.